Currency Linked Deposit

Currency Linked Deposit, a structured deposit offering you potential interest returns from foreign currency investment

What is Currency Linked Deposit?

Combining time deposit with currency option (derivatives), Currency Linked Deposit (CLD) is a structured deposit where you can enjoy both time deposit interest and enhanced interest derived from the currency option, offering you with higher interest returns.

Invest in Currency Linked Deposit

- Flexible

foreign currency investment for investors

Currency Linked Deposit is suitable for investors who are looking for enhanced return on foreign currency deposit and willing to accept foreign exchange risks. Usually, investors believe the foreign exchange movement will be stable and are willing to hold either the deposit or linked currency for specific purposes such as studying and traveling. - Various

currency combinations for you to choose from

Major currency combinations of HKD or USD with major currencies including AUD, CAD, EUR, GBP, NZD, CHF, RMB and JPY and cross currency pairs are available for you to choose from, coupled with deposit durations from 1 week to 6 months to suit your investment objective. - Affordable

deposit amount for you to start

The minimum deposit amount is HKD40,000 or equivalent with no safe custody charge or handling charges.

How does Currency Linked Deposit work?

To set up a Currency Linked Deposit, you need to select the deposit currency, linked currency, deposit duration and conversion rate.

Upon maturity, the maturity amount will be paid in either deposit currency or linked currency, depending on the exchange rate on Fixing Date.

| Maturity Amount | |||||||||||||||||||||||||

|

+ |

|

= |

|

|

|

|||||||||||||||||||

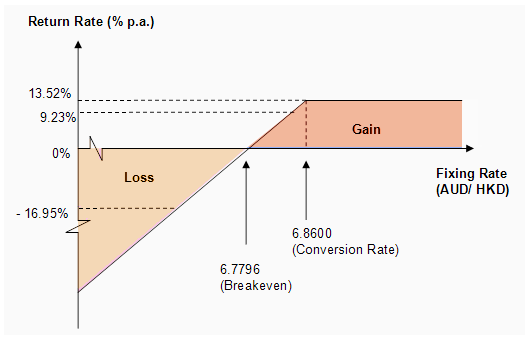

Return & Risk Comparison of Currency Linked Deposit

Table 1- Illustrative Example

| Deposit Currency | HKD |

| Linked Currency | AUD |

| Deposit Date | 28 Aug, 20xx |

| Fixing Date | 28 Sep, 20xx (Hong Kong Time 14:00) |

| Maturity Date | 29 Sep, 20xx |

| Deposit Duration | 32 days |

| Spot Rate | AUD/HKD 6.8800 |

| Conversion Rate | AUD/HKD 6.8600 |

| Interest Rate (%p.a.) | 13.52% |

| Deposit Amount | HKD100,000 |

| Maturity Amount (Deposit amount plus interest) |

If the Fixing Rate is at or above

the Conversion Rate, HKD101,185.32# in total will be paid.

If the Fixing Rate is below the Conversion Rate, AUD14,750.05* in total will be paid. In the worst-case scenario, you will lose your entire deposit amount if AUD becomes valueless. |

Table 2 - CLD Return Example

| Scenarios | Fixing Rate | Conversion Rate | Maturity Amount | Net Gain / Loss | Return Rate(%p.a.) |

|---|---|---|---|---|---|

| Scenario 1- AUD strengthens against HKD or remains unchanged |

6.9000 | 6.8600 |

HKD 101,185.32 |

HKD 1,185.32 |

Gain |

| Scenario 2 - AUD weakens against HKD |

6.8345 | 6.8600 |

AUD 14,750.05 |

HKD 809.22 |

Gain |

| Scenario

3 - AUD weakens against HKD |

6.7796 | 6.8600 |

AUD 14,750.05 |

HKD 0.00 |

Breakeven |

| Scenario 4 - AUD weakens against HKD |

6.6789 | 6.8600 |

AUD 14,750.05 |

- HKD 1,485.89 |

Loss |

| Scenario 5 - AUD becomes valueless |

- | 6.8600 |

AUD 14,750.05 |

- HKD 100,000.00 | Total Loss |

CLD Return Example Analysis Diagram

The above diagram is for reference only

and the scale of the diagram is not in proportion. The actual performance of

the product may differ from the examples shown.

Note:

# Deposit Amount

+ (Deposit Amount X Interest Rate X Deposit Duration / Day Count Basis)

= HKD100,000

+ (HKD100,000 X 13.52% X 32 days / 365 days)

= HKD 101,185.32

* [Deposit

Amount + (Deposit Amount X Interest Rate X Deposit Duration / Day Count Basis)] /

Conversion Rate

= [HKD100,000 + (HKD100,000 X 13.52% X 32 days / 365 days)]

/ 6.8600

= AUD14,750.05

^ HKD equivalent = Maturity Amount X Fixing Rate

Start your investment

plan today!

Investment

Services Hotline: (852) 2526 5555

Website: www.winglungbank.com

Important Notice:

This is a structured product involving derivatives. The investment decision is yours but you should not invest in currency linked deposit unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

Risk Disclosure Statement:

Not a protected deposit - The interest which may become payable on a CLD is generally higher than the interest on a normal time deposit. CLD is not the same as, and should not be treated as a substitute for, normal time deposits. CLD is not a protected deposit and is not protected under the Deposit Protection Scheme in Hong Kong. This structure product is not covered by the Investor Compensation Fund. Unless with consent from Wing Lung Bank (the “Bank”), CLD cannot be withdrawn (in part or in full), terminated or cancelled prior to the maturity. You may suffer losses for withdrawal, termination or cancellation of CLD prior to the maturity. The above information is for reference only and does not constitute and should not be regarded as any recommendation, offer or solicitation to purchase or sell any investment products. Investment involves risks and the price of investment products may fluctuate or even become worthless. Past record is not an indicator of future performance. Losses may be incurred rather than making a profit as a result of investment. You should carefully and independently consider whether the investment products are suitable for you in light of your investment experience, objectives, financial position and risk profile. Independent professional advice should be obtained if necessary. Please read the relevant terms and conditions together with the risk disclosure statements before making any investment decisions.

This document has not been reviewed by the Securities and Futures Commission of Hong Kong.

Detailed risk disclosure can refer to the following document: