Frequently Asked Questions (FAQ)

- Frequently Asked Questions (FAQ)

Travel Insurance 2.0

- 1.

- When is the earliest effective date for online application of Travel Insurance 2.0?

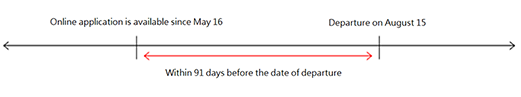

The earliest effective date for online application is 91 days before your departure. For example,

- 2.

- Can I apply for Travel Insurance 2.0 if I am not departed from Hong Kong?

To effect the Travel Insurance 2.0 Policy, all journeys must be departed from Hong Kong.

- 3.

- Can I apply for Travel Insurance 2.0 if I hold foreign passport?

Yes. Please go to any of our branches of CMB Wing Lung Bank for application.

- 4.

- Is there any age limit for the insured person?

For Single Journey

Coverage is available from 3 months to

80 years of age before the inception of the journey. Children aged between 12 and

18 years, coverage can be enhanced by paying adult’s premium but they can only

be covered under the GOLD and SILVER PLAN. For individually insured children, they

must obtain consent from their parent or guardian. Also, parent or guardian needs

to visit our branch to complete the application for their children in person.

For

Annual Cover

The insured person must be below 70 years old on the first

commencement date of the policy, and renewable up to 80 years old.

- 5.

- I lost my mobile phone during the journey, could I be compensated?

Our "Travel Insurance 2.0" Diamond Plan and Gold Plan cover the loss of or damage to electronic devices, including mobile phones, laptops, notebooks, tablets, etc. (Find out more in Terms and Conditions )

- 6.

- What can I do when I get injured during the journey?

Unfortunately, if you get injured in your journey, you should go to the local hospital or authorized clinic immediately. Remember to keep the original medical receipt and report for the relevant medical expenses claims. More Claim Notices

- 7.

- Can I get any compensation for any loss if the travel agency suddenly closes down?

Our Travel Insurance 2.0 does not cover any loss due to close-down of the travel agency. However, you can make your claim(s) to the “Travel Industry Compensation Fund”. (Website:www.tia.org.hk/index.html)

- 8.

- If my family member/friend suffers from an accident and is injured seriously during the journey, what kind of overseas assistance does this plan offer?

You can call “WORLDWIRDE EMERGENCY ASSISTANCE” Hotline at (852) 2862-0193 at any time for medical advice, arrangement of hospital admission, emergency medical evacuation, repatriation, etc. The services are provided by an appointed emergency assistance provider. Customers need to pay for the International Call services.

- 9.

- May I apply for the Travel Insurance 2.0 for my children who plan to participate in exchange programme or an oversea study?

As long as your children do not involve in any manual labor work, our Travel Insurance 2.0 can cover any accidental property loss and injury medical costs. You should notice that the single travel plan covers a trip up to 180 days and annual travel plan covers unlimited number of trips with 90 days per trip.

- 10.

- What should I do if my journey delays due to mechanical fault or bad weather?

- If your journey is delayed for 6 consecutive hours or more due to mechanical fault/adverse or severe weather conditions or natural disasters of earthquake, tsunami or volcanic eruption, you can request for carrier report (including the reasons and date of delay) from your airline. Please keep the boarding pass and the air ticket for reporting a claim.

- Also, if you need to purchase essential items and clothing overseas due to baggage delay for 6 consecutive hours or more, you should keep the original receipt of the purchased items and request for carrier report (including the reasons and date of delay) from your airline for reporting a claim. More Claim Notices

- 11.

- What can I do if my personal belongings are stolen during the trip?

If your personal belongings are unfortunately stolen during the trip, you should report to the local police within 24 hours and keep the local police report for reporting a claim after you return to Hong Kong. More Claim Notices

- 12.

- Why should I need an Annual Travel Insurance 2.0 Plan?

If you often go travelling and want to save time and money, an Annual Travel Plan is suitable for you. One-time application can cover for the whole year. Click Here for more information.

Sweet Home Insurance

- 1.

- If the building has already been covered under Fire Insurance or Building Owners Corporation's Third Party Liability Insurance, is it necessary to apply for Sweet Home Insurance?

Fire Insurance mainly compensates property damage of the building structure such

as walls, windows, ceilings, floors, water pipes and the property’s original

fixtures and fittings caused by fire.

The coverage of Building Owners’

Corporation Third Party Liability Insurance mainly includes public area of the building.

Sweet Home Insurance covers the following:

1) The

substantial loss and damage of household contents caused by any of the unforeseeable

accidents.

2) Legal liability as an occupier, tenant or personal capacity to

third parties.

If you already have a Fire Insurance, you can consider applying for Sweet Home Insurance for a comprehensive protection.

- 2.

- Will the improvements and betterments on walls, windows, ceilings, floors and doors caused by an accident be covered under Household Contents?

|

Condition 1: |

If the improvements and betterments have been existed in your house when you buy it, it cannot be covered under the Household Contents of Sweet Home Insurance. The above contents are covered under Building. Therefore, you can select the optional benefit of Building for a comprehensive protection. |

|

Condition 2: |

If the improvements and betterments are changed or improved by the insured, they will belong to Household Contents and be covered under this policy. |

|

Condition 3: |

|

|

Condition 4: |

If the improvements and betterments are purchased from the developer with an additional cost as a package but the insured does not buy the house as first–hand buyer, they cannot be covered under Household Contents. |

- 3.

- Does Sweet Home Insurance cover the loss of personal effects kept in the hotel or at an alternative accommodation when I prepare for overseas emigration?

For a maximum period of one month counting from the date you vacate the insured home, Sweet Home Insurance policy will be extended to cover the loss of your personal effects whilst kept in the hotel or at an alternative accommodation when you prepare for overseas emigration.

- 4.

- If I apply for Sweet Home Insurance, what are the items that my domestic helper who is residing in my home to be covered by this policy?

|

Coverage 1: |

The accidental loss of stolen or accidental damage to personal effects (excluding money and valuable properties) of your domestic helper residing in your home. |

|

Coverage 2: |

The legal liability in the event of your domestic helper’s negligence causing third party bodily injury or property damage. However, the policy does not cover any of the intentional or illegal behavior. |

- 5.

- If there are structural changes of the home or open-kitchen is used, does it impact on the coverage of Sweet Home Insurance?

According to the terms and conditions of Sweet Home Insurance, if the structural changes do not violate the Building Management Ordinance and other related rules and regulations, or such structural changes have already been approved by Buildings Department of the HKSAR Government, the coverage will not be affected.

- 6.

- If the water pipe bursts accidentally, what will be covered? Does Sweet Home Insurance policy cover the public liability if this causes damage to other property downstairs?

In the event of burst pipe, in general, Sweet Home Insurance will cover the following for Landlord and Tenant:

- Loss of or damage to your household contents;

- The cost of damage to household contents due to temporary removing away from the property on the way for repairing, cleaning or modification.

If there is other property suffering from the water damage caused by your burst pipe where you are held legally liable in this situation, Sweet Home Insurance will cover your personal liability for such damages. Without prior written consent from CMB Wing Lung Insurance Company Limited, you must not make any admission, offer or promise of payment to third parties.

- 7.

- Does Sweet Home Insurance cover body injury or property damage caused by animals?

We only cover third party’s body injury or property damage caused by domestic dogs or cats legally raised by the insured person.

- 8.

- If I rent a house, can I apply for Sweet Home Insurance?

Yes, you only need to apply for the Basic Benefits under Sweet Home Insurance, which have the coverage of household contents and personal & occupier’s liability.

- 9.

- What is the earliest effective date for Sweet Home Insurance?

Once your application form is completed and approved by CMB Wing Lung Insurance Company Limited, the policy will be effective immediately after you pay the policy premium.

- 10.

- How can I apply for automatic renewal of my Sweet Home Insurance?

In order to have a continuous coverage in a simple way, you only need to select Automatic Renewal Instruction on the application form. By doing this, we will directly debit your authorized account for the premium of next renewal policy period before the expiry of your policy. And your policy will be automatically renewed at the end of each policy year.

- 11.

- If I have already applied for Sweet Home Insurance and in the event of an accident, what should I do?

You should complete the claim form and notify CMB Wing Lung Insurance Company Limited

in writing within 14 days from the date of accident, together with all supporting

documents and evidence. If it involves third party’s property damage or body

injury, you should report the issue to your own Property Management Office and notify

CMB Wing Lung Insurance Company Limited while requesting the related report from your

Property Management Office. In the meantime, you must not make any admission, offer

or promise of payment to third parties without prior written consent from CMB Wing

Lung Insurance Company Limited.

You may click here to get more information or contact us at

2830 5400 or download the claim form directly. Please complete the claim form and

send to CMB Wing Lung Insurance Company Limited with relevant supporting documents.

You may also submit the claim form to CMB Wing Lung Insurance Company Limited via

any of CMB Wing Lung Bank branches.

Helper Insurance

- 1.

- What is Waiting Period?

It is a 15-day waiting period from the policy inception date for each Domestic Helper Insurance Policy. No benefits shall be payable under Clinical Expenses, Surgical & Hospitalization Expenses, Dental Expenses and Loss of Service Cash Allowance during the waiting period.

- 2.

- Is there any age limit for insured CMB Wing Lung Insurance “Helper Insurance”?

Age limit for CMB Wing Lung Insurance “Helper Insurance” is from 18 to 60.

- 3.

- What kind of insured plans can Local/Foreign Helper Insurance apply for?

Local/Part-time domestic helper can only be insured under Plan A of CMB Wing Lung Insurance “Helper Insurance”. Foreign domestic helper can be insured under Plan A ,B or C of CMB Wing Lung Insurance “Helper Insurance”. Except for the statutory Employees’ Compensation insurance, other coverage such as medical expense is provided to fulfill the employer’s responsibility to employees based on the employment contracts. Therefore, CMB Wing Lung Insurance “Helper Insurance” Plan B or C are suitable for employer with foreign domestic helper.

- 4.

- Is there a choice of insurance period for a Helper Insurance?

All plans of CMB Wing Lung Insurance “Helper Insurance” provide choices of insurance period between one to two years.

- 5.

- Can I apply for CMB Wing Lung Insurance “Helper Insurance” for my relatives or friends?

No. The insured domestic helper should have employment relationship with the insured.

- 6.

- If my domestic helper’s employment contract has been expired or I want to dismiss my domestic helper with some reasons, can I cancel the policy?

Yes. You should notify CMB Wing Lung Insurance in writing and return your policy immediately. When we receive your application, we will cancel your policy and refund the premium of the unexpired period of the policy. Please note that the minimum and non-refundable premium of each policy for Plan A or B is HK$400 and HK$700 for Plan C.

- 7.

- If I replace a domestic helper, what should I do?

You should provide the copy of the new domestic helper’s passport together with the insurance policy number and effective date by post or e-mail or fax to CMB Wing Lung Insurance. You can also give the above information to any one of CMB Wing Lung Bank branches in person for passing to CMB Wing Lung Insurance. Please note that the waiting period will also apply to the new domestic helper.

- 8.

- My domestic helper has had an accident out of Hong Kong. Can I make a claim?

In general, the geographical area of this policy is limited to Hong Kong only. However, if the insured domestic helper suffers from an accidental injury or death in the course of employment when he/she accompanies the Insured in an overseas trip, the Insured is entitled to the protection under section of “Employer’s Liability”.

- 9.

- Can CMB Wing Lung Insurance “Helper Insurance” cover the expenses of heart disease or cancer?

CMB Wing Lung Insurance “Helper Insurance” does not include medical insurance of major illness. You can apply “Major Illness Medical Insurance Supplementary Plan” for this extra protection under the policy of CMB Wing Lung Insurance “Helper Insurance”. Please note that this extra plan is only applicable to foreign domestic helper. For details, please contact us at 2830 5400 for enquiries.

- 10.

- Can I make a claim for the expense of replacing a new domestic helper?

The expenses of the replaced domestic helper can only be compensated when the insured domestic helper is repatriated due to serious illness, injury or death.

Personal Accident (Plus) Insurance

- 1.

- Who can apply for CMB Wing Lung Insurance “Personal Accident (Plus) Insurance”?

Anyone including housewife or student can apply for CMB Wing Lung Insurance “Personal Accident (Plus) Insurance”. To enjoy the comprehensive protection, you simply need to select the class of your occupation in the application and settle the premium. For details, please refer to Classification of Occupation and Main Exclusion . Besides, the insured person should meet the following requirements:

- Must hold a valid Hong Kong Identity Card and normally residing in Hong Kong.

- Age between 12 and 65 and renewable up to the age of 70.

- Age between 12 and 18 can only be insured under Plan 1 and must obtain consent from their parent(s) or guardian.

- 2.

- What is the definition of an “accident”?

“Accident” means any sudden unforeseen and unexpected event of violent accidental external and visible nature which shall independently of any other cause be the sole and direct cause of Injury.

- 3.

- Is the insured required to undertake a health examination?

If the insured has bodily disablement or adverse medical condition, our company will require him/her to provide medical assessment report and may charge additional premium or impose additional clause or reject the application.

- 4.

- If I am accidentally infected by disease, can I make a claim?

Any kind of sickness or disease even if contracted by accident is not covered under the policy. However, this does not exclude bacterial infection which is the direct result of cut or wound caused by an accident.

- 5.

- If I apply for Personal Accident Insurance with more than one insurance company, can I claim compensation from all the insurance companies?

You must declare the information about similar insurance plan(s) being covered

(including the life insurance) when you apply for CMB Wing Lung Insurance “Personal

Accident (Plus) Insurance”. If you have applied for Personal Accident Insurance

with more than one insurance company, we can only cover the excess amount of the medical

expense incurred by accidents having claimed from another source.

However the

benefits of “Accidental Death” and “Permanent Disablement”

are not affected in this respect.

- 6.

- Does CMB Wing Lung Insurance “Personal Accident (Plus) Insurance” cover Chinese Bonesetter, Acupuncturist and Chiropractor treatment expense?

This policy has extended benefits within 12 consecutive months from the date of accident including:

- Registered/listed Chinese Bonesetter, Acupuncturist and Chiropractor treatment expense

- Physiotherapist Expenses

The above is limited to maximum 5 visits per year for each benefit and subject to maximum limit of the extension benefits. For details, please refer to the policy schedule.

- 7.

- What is Automatic Renewal?

If you have authorized CMB Wing Lung Insurance to renew your policy automatically in the proposal form, the policy will be automatically renewed at the end of each policy year. You should be aware that:

- No notice of amendment to the renewal terms and conditions has been sent to you prior to the expiry date of your existing policy, and

- You have authorized us to directly debit your CMB Wing Lung Bank account or CMB Wing Lung credit card or your other credit card for the premium of next renewal policy period.

- 8.

- What should I do if emergency assistance is required abroad?

You can contact Inter Partner Assistance Hong Kong Ltd (IPA) at (852) 2861-9293 for medical advice, arrangement of hospital admission, emergency medical evacuation, repatriation, etc. For more services and terms and conditions please click here . All successful applicants of CMB Wing Lung Insurance “Personal Accident (Plus) Insurance” are entitled to the above services.

The above information is provided for reference

only. If you have further questions which

are not mentioned above, please

feel free to send us email (enquiry@cmbwinglunginsurance.com) with the question(s) and contact

details or you can call us at 2830 5400 for enquiry.