Currency Linked Investment

Currency Linked Investment (CLI), a structured product offering you potential interest returns from foreign currency investment

What is Currency Linked Investment?

Currency Linked Investment is a structured product where you can enjoy enhanced interest derived from the currency option, offering you with higher interest returns.

Invest in Currency Linked Investment

- Flexible

foreign currency investment for investors

Currency Linked Investment is suitable for investors who are looking for enhanced return on foreign currency investment and willing to accept foreign exchange risks. Usually, investors believe the foreign exchange movement will be stable and are willing to hold either the investment or linked currency for specific purposes such as studying and traveling. - Various

currency combinations for you to choose from

Major currency combinations of HKD or USD with major currencies including AUD, CAD, EUR, GBP, NZD, CHF, SGD, RMB and JPY and cross currency pairs are available for you to choose from, coupled with investment durations from 1 week to 6 months to suit your investment objective. - Affordable

investment amount for you to start

The minimum investment amount is HKD40,000 or equivalent with no safe custody charge or handling charges.

How does Currency Linked Investment work?

To set up a Currency Linked Investment, you need to select the investment currency, linked currency, investment duration and conversion rate.

Upon maturity, the maturity amount will be paid in either investment currency or linked currency, depending on the exchange rate on the fixing date.

Return & Risk Comparison of Currency Linked Investment

Table 1- Illustrative Example

| Investment Currency | HKD |

| Linked Currency | AUD |

| Transaction Date | 28 Aug, 20xx |

| Fixing Date | 28 Sep, 20xx (Hong Kong Time 14:00) |

| Maturity Date | 29 Sep, 20xx |

| Investment Duration | 32 days |

| Spot Rate | AUD/HKD 6.8800 |

| Conversion Rate | AUD/HKD 6.8600 |

| Interest Rate (%p.a.) | 13.52% |

| Investment Amount | HKD100,000 |

| Maturity Amount (Investment amount plus interest) |

If the Fixing Rate is at or above

the Conversion Rate, HKD101,185.32# in total will be paid.

If the Fixing Rate is below the Conversion Rate, AUD14,750.05* in total will be paid. In the worst-case scenario, you will lose your entire investment amount if AUD becomes valueless. |

Table 2 - CLI Return Example

| Scenarios | Fixing Rate | Conversion Rate | Maturity Amount | Net Gain / Loss | Return Rate(%p.a.) |

|---|---|---|---|---|---|

| Scenario 1- AUD strengthens against HKD or remains unchanged |

6.9000 | 6.8600 |

HKD 101,185.32 |

HKD 1,185.32 |

Gain |

| Scenario 2 - AUD weakens against HKD |

6.8345 | 6.8600 |

AUD 14,750.05 |

HKD 809.22 |

Gain |

| Scenario

3 - AUD weakens against HKD |

6.7796 | 6.8600 |

AUD 14,750.05 |

HKD 0.00 |

Breakeven |

| Scenario 4 - AUD weakens against HKD |

6.6789 | 6.8600 |

AUD 14,750.05 |

- HKD 1,485.89 |

Loss |

| Scenario 5 - AUD becomes valueless |

- | 6.8600 |

AUD 14,750.05 |

- HKD 100,000.00 | Total Loss |

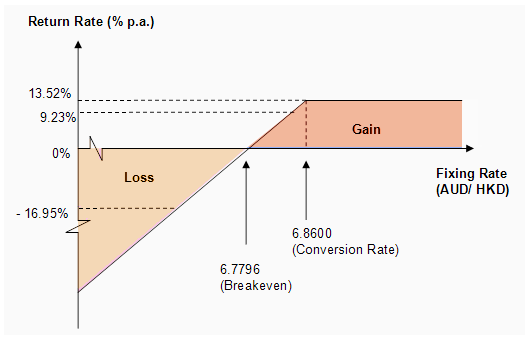

CLI Return Example Analysis Diagram

The above diagram is for reference only

and the scale of the diagram is not in proportion. The actual performance of the product

may differ from the examples shown.

Note:

# Investment Amount + (Investment

Amount X Interest Rate X Investment Duration / Day Count Basis)

= HKD100,000

+ (HKD100,000 X 13.52% X 32 days / 365 days)

= HKD 101,185.32

* [Investment

Amount + (Investment Amount X Interest Rate X Investment Duration / Day Count Basis)]

/ Conversion Rate

= [HKD100,000 + (HKD100,000 X 13.52% X 32 days / 365

days)] / 6.8600

= AUD14,750.05

^ HKD equivalent = Maturity Amount X Fixing Rate

Start your investment

plan today!

Investment

Services Hotline: (852) 2526 5555

Website: www.cmbwinglungbank.com

Important Notice:

This is a structured product involving derivatives. The investment decision is yours but you should not invest in currency linked investment unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

Risk Disclosure Statement:

Not a protected deposit - CLI is not the same as, and should not be treated as a substitute for, normal time deposits. CLI is not a protected deposit and is not protected under the Deposit Protection Scheme in Hong Kong. This structure product is not covered by the Investor Compensation Fund. Unless with consent from CMB Wing Lung Bank (the “Bank”), CLI cannot be withdrawn (in part or in full), terminated or cancelled prior to the maturity. You may suffer losses for withdrawal, termination or cancellation of CLI prior to the maturity. The above information is for reference only and does not constitute and should not be regarded as any offer to purchase or sell. Investment involves risks and the price of investment products may fluctuate or even become worthless. Past record is not an indicator of future performance. Losses may be incurred rather than making a profit as a result of investment. You should carefully and independently consider whether the investment products are suitable for you in light of your investment experience, objectives, financial position and risk profile. Independent professional advice should be obtained if necessary. Please read the relevant terms and conditions together with the risk disclosure statements before making any investment decisions.

This document has not been reviewed by the Securities and Futures Commission of Hong Kong.

Detailed risk disclosure can refer to the following document: